The process of granting mortgage loans

The mortgage lending process is considered to be one of the more complex credit processes offered to retail customers. Making decisions for such long-term liabilities for considerable amounts of money requires a thorough analysis of both customers and collaterals.

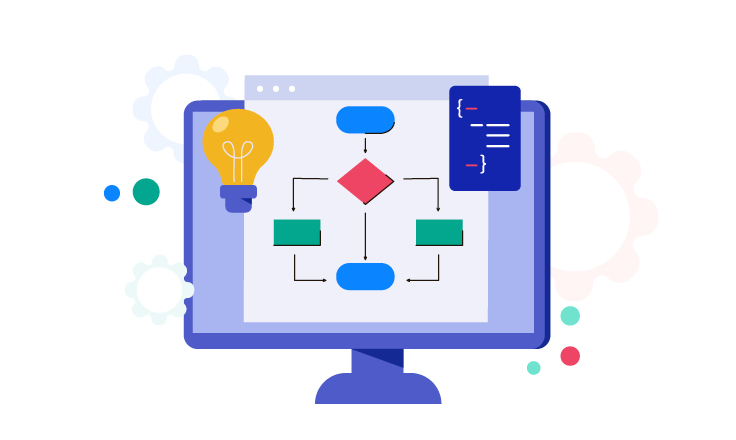

This is why it is so important to properly assess customer creditworthiness, which significantly reduces the risk of potential losses and, as a result, the percentage of ‘bad’ loans in the bank's portfolio. From the banker's point of view, the process can be divided into the following stages:

- Application submission, often preceded by a simulation of conditions

- Application analysis and customer verification

- Customer risk and credit rating (scoring)

- Credit decision

- Contract and fund disbursement

However, from the customer's point of view, the individual stages are less important – for the customer, the most important factor is the so-called time-to-money, i.e. how long it takes from the moment the application is submitted to the moment the money is received.

For many customers trying to buy a new apartment, it is the shortest time to grant a loan, not the most attractive price that determines the choice of a specific offer. Too slow a process can also lead to the fact that the chance to buy a property at an attractive price will pass the customer by. A bank also loses out on the opportunity because a dissatisfied customer will probably not only decline another offer in the future but also voice their anger online. A dissatisfied customer more often shares their experience with the bank than a satisfied one - as a result, a negative opinion about the bank may easily be disseminated – and discourage potential customers.