A nationwide universal bank, serving all market segments in Poland wanted to go with the implementation of a new digital banking ecosystem for business customers, with comprehensive access to modern services, automatic processes, in an environment that is safe for the customer and the bank. The bank looked for a right way combine three major elements: latest technology, customer knowledge and omnichannel service.

Technology allows to understand customer behavior, learn customer preferences and thus effectively respond to their needs, build better experiences and long-term customer loyalty across multiple channels. The ability to predict customer behavior and a personalized approach to their needs can only work effectively if the bank takes care of full integration of its sales and service channels.

Goal: to ensure that all customer service and contact channels integrate with each other that would be unnoticeable for the customer. As a result, trust in the bank will be built, and customers will be guaranteed consistency and transparency, regardless of which channel they use.

As part of the new solution, the bank’s intention was to maintain flexibility of the solution, ease of the customer–bank communication, as well as high customer freedom in portfolio management.

One of the key elements of implementing the new solution was data migration from the current solution to the new one.

As for he high-level business goals of the project the emphasis was put on the increase in three major areas of bank’s interest: the number of active users, number of transactions, and the bank's revenues.

Preliminary internal estimates of the bank assume implementation works for approximately 24 months.

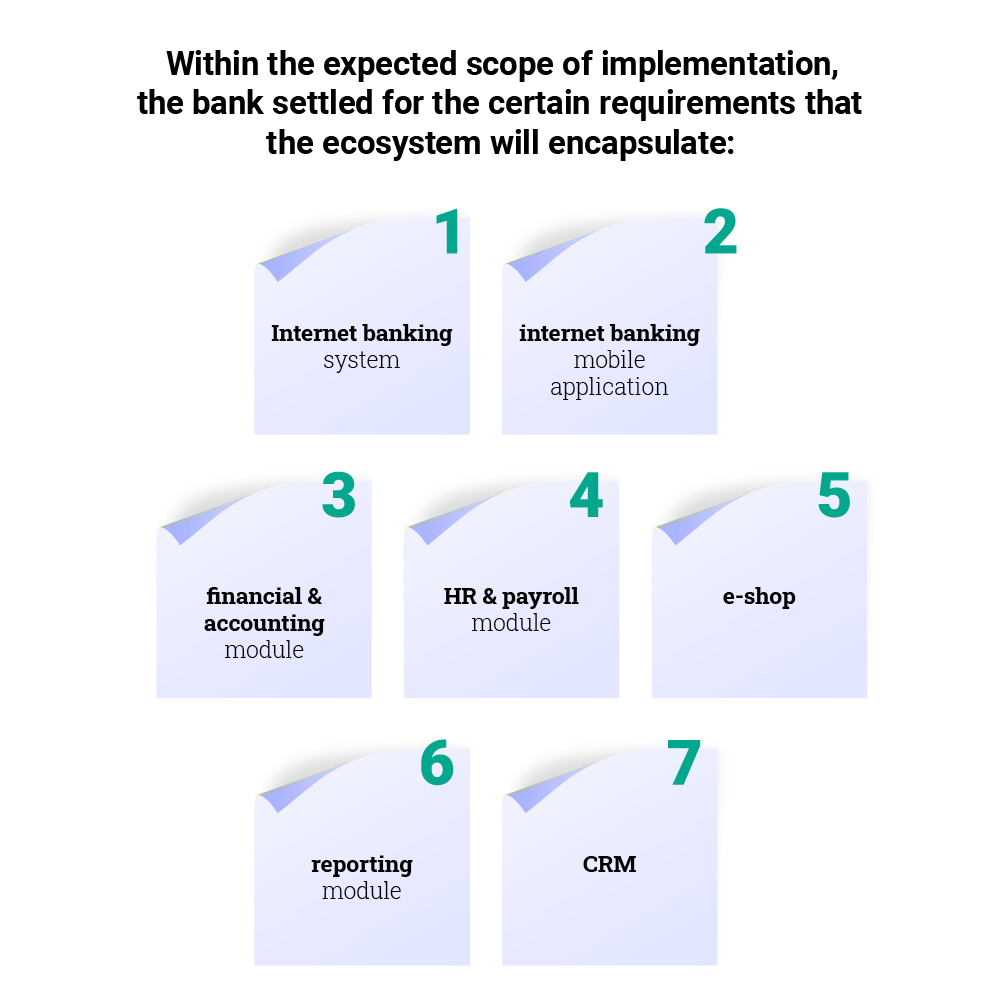

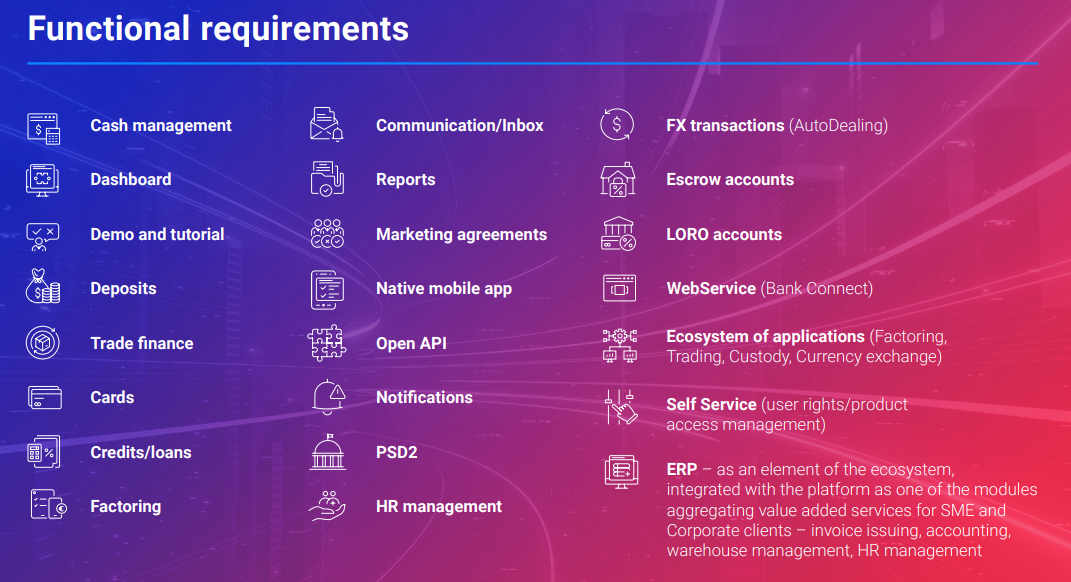

From the beginning, the RFP published by the bank was a very complex endeavor – the client wanted to revolutionize the Polish banking scene by introducing a comprehensive ecosystem of solutions addressed at its SME and Corporate clients. Focused not only on revamping of their current digital banking system, the aim was to integrate multiple value added services into the platform which would become a single point of digital contact for smaller and larger companies alike, providing not only banking products but also additional features, such as invoicing and accounting, through one unified user portal.

There were many companies invited to take part in the proceedings, which lasted for many months – comprising of multiple whole-day business and technical workshops, looking into every detailed feature that was requested, following the presented processes to fully understand the value of each solution. What is more, the bank wanted to explore the possibility of modifying and extending the platform with help of their own IT teams – this was a crucial factor, as the bank wanted to emerge from this transformative effort as a more agile organization, with the ability to take control of the evolution of the digital banking platform using their own resources and keeping the intellectual property rights.

"From the first releases, the new platform allows its joint development together with the bank's IT. Thanks to the open architecture, the client has the possibility to share their own solutions on the platform."

Rafał Kwieciński, Head of Production at Comarch

As a gateway to adopting nimbleness throughout the organization, the planned project was inevitably a colossal undertaking. Nevertheless, as a result of the tender proceedings, Comarch was selected as partner that would help the client with the transformation effort. There were 3 key factors that bolstered Comarch’s status as the ultimate vendor.

The project start was scheduled at the beginning of 2023 with the expectation to be completed within 2.5 years, until the end of H1 2025, with the first product release in July 2024.

"The client has decided to replace one of the first versions of our product with a newer version that has undergone a total technological metamorphosis. The new system solves the problems that limited further growth and handling of new client requirements for automatic processing of increasing transaction volumes."

Jakub Cieślewicz, Product Manager at Comarch

"The new banking system means even better omnichannel processes. The new mobile application makes it possible not only to respond to current market needs in terms of functionality and modern authorization methods, but also to shorten the time to market for new functions provided in a hybrid manner – integration of the native solution with functionalities produced for the web."

Jakub Cieślewicz, Product Manager at Comarch

Tell us about your business needs. We will find the perfect solution.