Software for Sales and Services Channel

Sales and Services Channel management is one of the most important processes at bank. There is a special software dedicated to that area of bank activity. See the examples of that kind of systems.

Comarch Front End (CAFE) – an integrated client consultant work environment, available in any chosen financial institution. It covers client portfolio functionalities, the Comarch CRM system module – chosen by the client – and operational modules, which allow the total servicing of the bank branch or insurer using one application environment. The environment is realized using web technologies.

Comarch Investment Advisor – a system which supports the realization of wealth management services dedicated to investment consultants. It allows the exploration of client needs and predispositions as well as choosing the best possible investment strategy. The system fulfills the requirements of financial institutions with regards to bettering communication with the client, a deeper understanding of their needs, investment profile and education. This is geared toward building long term relations with the bank as well as a better understanding by the client of the principles of investment and the risk connected. The Comarch Investment Advisor system is based on the CAFE system – widened to include a (MiFID compliant) research module, which checks the responsibility and adequacy of the client, as well as a tool which analyzes the investment profile and builds investment strategies.

Comarch CRM Sales Management – a new generation, integrated, front-end application. It guarantees a complex client relations service from the first acquisition, through to the launch of sales programs (cross/up-selling), to an up to date operational handling, using the whole scope of the product offer. The system covers functionality for front-office (Sales Application) employees, who work directly with clients, as well as middle and back-office employees (Branch Director Application, Central Application) responsible for managing the sales process.

Comarch Contact Center – a strategic point of contact, which allows the integration of all the communications channels with the client: telephone (conversations, voice mail, text messaging), fax, email and Internet. The solution increases the company’s competitiveness through the creation of strong client relations. It also increases effectiveness and the efficiency of communication and gathers and manages information about clients. Comarch Contact Center is a modern, modular and easy to develop platform used to effectively service any type of communications channel using the automatic IVR service as well as handling by client consultants. The Comarch solution is based on its own integrated application and supported by advanced mechanisms from chosen tools platforms.

Comarch CRM Claim Management – the solution deals with the complex management of complaints. It constitutes a platform module that manages client relations – Comarch CRM. The system is based on a proven ‘Service-Profit Chain’ mechanism used by companies which are the unquestionable leaders on individual markets. The mechanism automatically links the quality of internal and external services (including complaint management) with financial results. The solution means that the company is able to link the question of the funds used to maintain a high level of service with the expected financial results.

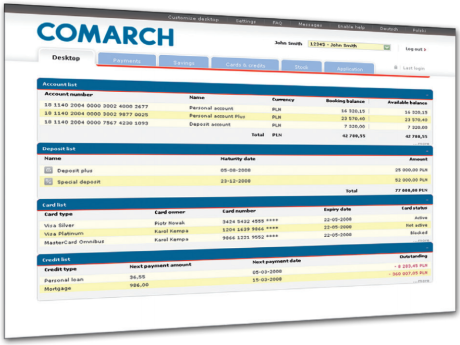

Comarch Internet Banking – the system guarantees clients from all segments access to services offered by the bank, 7 days a week, 24 hours a day, using the Internet and smart phone. Thanks to integration with various central systems, it is a universal, complete, efficient and safe supplement to the bank’s IT environment. The Comarch Internet Banking platform offers solutions, which carry out financial services through the self service channel, fulfilling large expectations of banks, brokerage houses, investment funds and other financial institutions. It is also an integration platform, which links services and products offered by one financial institution, or by a whole financial group, into a whole.

|

Internet Banking System is nowadays a must-be for customer

Comarch Mobile Banking – mobile financial services, which are becoming increasingly popular, are a natural consequence of technological advances. Comarch created an application which allows the managing of finance using mobile devices. Thanks to Comarch Mobile Banking, a money transfer, investment task, balance check or other banking operations are possible using a mobile phone.

Comarch Internet Investments - an independent system or functional supplement to Comarch Internet Banking. It guarantees access to investment financial services through the Internet and other electronic distribution channels for brokerage house clients, trustees, investment funds, open pension funds as well as other institutions which operate on the capital market. The system has been continually developed since 1998 and offers the richest functionality on the market in terms of access to the brokerage account, investment funds register and specialized investment products.

Comarch Online Trading (NOL3) – the most modern tool on the Polish market, which allows access to date stock exchange listings and market information, market analyses as well as individual stocks. It also realizes tasks typical for Order Management System (OMS) solutions such as making dispositions directly from the listings table and sending them to the market at the right moment.

Comarch Credit Process Management – a set of applications which support the handling of credit processes in all client segments: corporate, retail and SME. The module based system makeup allows an optimal set of functionalities to be chosen. It also supports the most important processes to do with the handling of any credit products for any client segment: product construction, simulation, application preparation, support for the decision making process, agreement preparation, fund disbursing, collateral management, monitoring of active agreements, transaction settlement, sales network management, calculating commissions and debt collection from unreliable clients. The corporate Comarch Credit Process Management application has been extended to include additional tools, which are specific for this client segment. These include the rating engine, ratio analysis module or extended collateral management. Similarly to CRM solutions, when designing a system which supports the credit process for large companies, emphasis was placed on the elasticity of the decision making mechanism so that the propositions generated automatically do not stifle process management policies on a level characteristic for the retail segment.