All You Need to Know about e - Invoicing in the Kingdom of Saudi Arabia

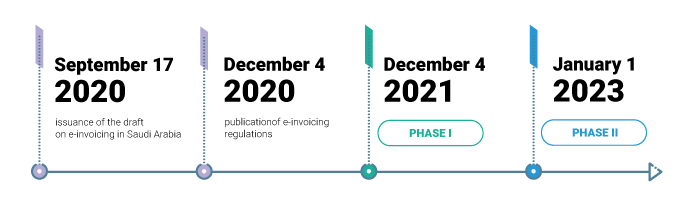

The Saudi Arabian e-invoicing journey

The Kingdom of Saudi Arabia takes a major step towards preventing tax fraud

by implementing electronic invoicing across the country. The paperless strategy aims to contain the shadow economy, save time and resources, and protect the environment.

In accordance with the new law, the implementation of e-invoicing (FATOORA) will be rolled out in two major stages:

- GENERATION PHASE - enforceable as of December 4, 2021

- INTEGRATION PHASE - starting from January 1, 2023 (postponed from June 2022)

Who will be affected by this obligation?

The resolution will apply to Saudi Arabian residents subject to VAT and any third party issuing tax invoices on behalf of taxpayers. Furthermore, the following categories of transactions are exempt from the e-invoicing regulations:

- Exempt supplies

- Import of goods to the Kingdom

- Supplies subject to the reverse charge mechanism

Key requirements

On December 4, 2020, The General Authority of Zakat and Tax (GAZT), later known as ZATCA, released regulations outlining technical and procedural requirements for the upcoming e-invoicing mandate.

GENERATION PHASE

Following ZATCA’s announcement, taxpayers subject to e-invoicing regulations must be able to issue and store invoices (whether they constitute tax Invoice

or simplified tax invoice) and associated credit and debit notes, utilizing the electronic solution.

In terms of technical requirements, there is no mandatory file format for the generation phase. Nevertheless, e-invoices and associated notes must contain all the data fields required, such as the VAT number of buyer (tax invoice) or a mandatory QR Code (simplified tax invoice).

In addition to the above-mentioned prerequisites, the solution must allow taxpayers to export e-invoices and associated notes to an offline local archive.

INTEGRATION PHASE

According to the e-invoicing regulations, the second phase will be implemented in waves. ZATCA will notify selected taxpayers no later than six months prior to the enforcement date. Nonetheless, in order to fulfill the requirements imposed by the authority, the solution must be able to:

- Generate invoices and associated notes in the XML format or PDF/A-3 format (with embedded XML)

- Connect to the Internet

- Integrate with external system via application programming interface (API)

- Implement data security features, including hash, universally unique identifier (UUID) or cryptographic stamp

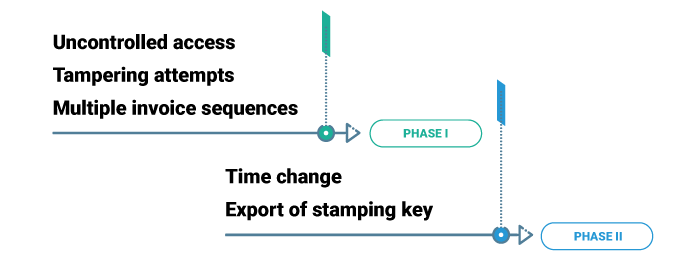

Under the new law, the following are strictly prohibited:

How to get ready for e-invoicing

In an effort to fully meet ZATCA’s requirements and speed up the readiness for change, taxpayers should approach an e-invoicing solution provider which can help them become e-invoicing enabled.

For further information please visit our website

Author: Laurencja Nowacka Business Solution Manager at Comarch

Contact: Laurencja.Nowacka@comarch.com